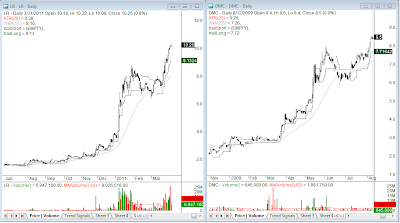

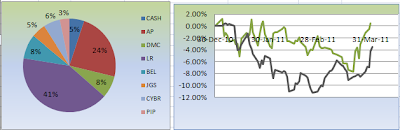

Thanks to Lolo, I made all those lost profits back. Seeing that LCB was holding strong during the bloodbath, I bought more with conviction. Let's see if this trade continues next week. :)

I was also very thankful to a tweet by DarvasTrader

"But remember that you don't need to sell everything as soon as a Downtrend begins. Stick to your stops. Some leaders WILL hold up. $$"

True!