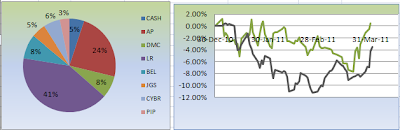

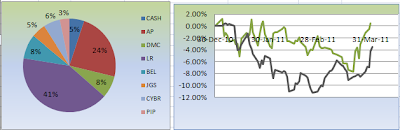

Here's my portfolio holdings and performance at the end of Q1. I should get an additional 2% when I get the cash dividend from my AP holdings. :) Good luck in Q2!

The line in green is my equity while the blue line is PSEi.

The information contained in this blog are my own opinions and analyses, provided for information purposes only and should not be construed as an offer to buy or sell securities.

Thoughts of a Novice Trader All Rights Reserved. Blogger Template created by Deluxe Templates

Wordpress Theme by Skinpress | Supported by Dante Araujo | Make Money Online

3 comments:

Crazy 1st quarter indeed. Interesting portfolio and money management. Was LR a big bet to begin with or just a big winner?

I feel like the current environment is more trend friendly already. Cheers and good luck in Q2!

averaged up heavily in LR! :) i'm glad i did coz if not, super down pa rin ako!

agree. sana nga. :) cheers!

ah so that's how it happened. I have LR too, 4.63% of portfolio. this year i've oscillated from about +5% to just below 0%. now i'm up 1%. only my brokers have been making money this year hahaha

Post a Comment